The Need to Take Personal Responsibility for Your Financial Health

The economic climate, both nationally and globally, is having significant negative effects on standards of living. Inflation, personal debt, lack of savings, job insecurity and other factors are impacting how, and to what degree, people are supporting themselves and their families.

These things are also affecting people’s future well-being – what their standards of living will be in their retirement years.

Many people depend on Social Security, but the program has been projected to become insolvent by 2035, or sooner. And the political will to solve the problem is currently not present. Even if Social Security continues on, it will not provide sufficient benefits for most people to live comfortably.

________________________________

With all its alluring promise that someone else will guarantee for a rainy day, Social Security can never replace the program that man’s future welfare is, after all, a matter of individual responsibility.

— Harold Stonier, former Vice President of American Bankers Association

________________________________

The news is just as bad, if not worse, for employer-sponsored retirement plans. People with these pension plans are likely to receive much lower payments than they anticipate … at a time in their lives when they need them the most.

And what about self-funded pensions, like IRAs and 401(k) plans? The performance of these plans depends largely on the investing savvy of those who own them; and Americans, as a whole, aren’t especially shrewd investors. Plus, many people who have access to these plans choose not to participate in them.

Also, longer life spans, more active retirements, and the rising costs of goods and services make it important, now more than ever, for people to take personal responsibility for their own financial affairs – to save and invest and to put in place plans that will prevent them from having to depend on others.

Unfortunately, many people do not feel that they can save and invest for the future, because they are just barely paying today’s bills. They hope to begin saving when they begin earning more.

But often, it comes down to the old-fashioned virtues of determination and discipline. Our goal is to help you to see that you can, indeed, begin – even now – to take some important steps toward financial security and independence.

The Value of Precious Metals

When it comes to investing, traditional investments are stocks, bonds and cash (or cash equivalents, like money market funds and CDs).

Alternative investments are things like real estate, commodities and collectibles. These kinds of investments can be more risky than traditional investments, but the advantages of owning them outweigh the disadvantages.

Of all the alternative investments, real estate and precious metals (particularly gold and silver) are the most popular. And in recent years, the demand for gold and silver has increased significantly.

We believe that precious metals can play an important role in creating and preserving wealth.

There are several strong reasons for owning precious metals.

- Precious metals provide an effective means of diversifying an investment portfolio. Experts have recommended that approximately 10% to 20% of an investor’s assets be devoted to tangible assets such as gold and silver.

- The metals themselves have intrinsic value – unlike a piece of paper that says that you own stock in a company. Their value will never be zero.

- Precious metals have almost universal appeal. Everyone loves gold and silver.

- Precious metals are not a renewable resource, so there is a rapidly diminishing supply.

- Gold and silver can provide a potentially substantial retirement fund – income that will supplement whatever other income you will have when you retire.

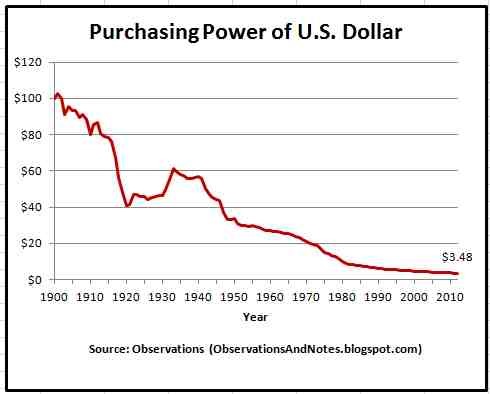

- Precious metals are a hedge against inflation, which is the loss of the purchasing power of currency. Inflation increases the price of goods and services – and decreases the value of the dollar. That is why a dollar today will not buy what it would in the past. But precious metals usually increase along with inflation, so inflation does not reduce their value. That is why an ounce of gold today can still buy essentially what it would in the past.

The U.S. dollar has been losing its value for many years, and chances are good that its devaluation will continue. One of the best ways of protecting ourselves against the weakness of the dollar is to own assets that have intrinsic value around the world. Precious metals have a proven record of holding their value. They offset the effects of the devaluation of the dollar and create a better opportunity to create wealth.

Precious metals can help to create and protect financial wealth, stability and independence – even during economically challenging times.

The Silver Bullet

Of all the precious metals, silver is especially good to own.

Like gold, silver has been used as money for a very long time, but silver has more practical uses than gold or other precious metals. It is used more heavily in both industrial and medical applications due to its versatility and unique chemical properties. Consequently, there is a greater demand for silver.

In fact, demand for silver is increasing rapidly, while supplies are quickly diminishing. More silver is being used than is being mined. We think of gold as more rare than silver, but there is actually more gold than silver above ground – that has already been mined. Plus, we have consumed 90% of all mined silver, Also, silver mining has declined dramatically in recent years, because it is less profitable to the mining companies.

All this means that there will be a huge shortage of silver in the years ahead. Think how that will affect the price of silver. It is only a matter of time before the price reconciles with the true value.

If the general public understood this, the demand for silver would accelerate even further.

But in spite of silver being in such high demand, it remains the least expensive of all the precious metals. It is probably the most undervalued asset on the market – at least for now.

Silver has a good record of increasing in value over time. In a recent four-year period (2009 to 2012), the price of gold increased over 100%, but silver increased over 200%. Analysts are predicting continued long-term increases.

_________________________________________

Here is an amazing illustration of the value of silver, compared to the U.S. Dollar.

In 1965, a dollar bill and a silver dollar had approximately the same value. You could buy a new Ford Mustang for about $2,500 and pay for it with either 2,500 dollar bills or 2,500 silver dollars.

Today, 2,500 dollar bills will only buy you an old, high-mileage Mustang (if you’re lucky), while 2,500 silver dollars will buy you a brand-new, high-end Mustang, worth $40,000.

These are compelling reasons to add physical silver to your portfolio.

The American Eagle Silver Dollar

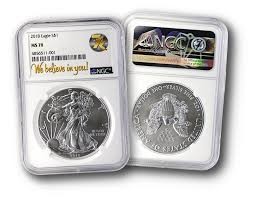

The American Eagle Silver Dollar is produced by the U.S. Mint as a non-circulating bullion coin. (A bullion coin is one that is valued primarily for its metal content.) It is legal tender, with a face value of $1, but its true value is based on its silver content, which is 1 oz. of pure silver.

A graded American Eagle is examined under magnification and if found to be without visible defect or flaw, it is given a perfect grade of MS70. It is then assigned a serial number and encased in hard-shell plastic to inhibit degradation.

Many other countries produce government-issued, 1-oz. silver coins, the more popular being the Canadian Maple Leaf, the Chinese Panda, the Austrian Philharmonic, and the British Britannia.

Commemorative silver coins feature unique tributes in honor of people, places and events and are also popular with both investors and collectors. These coins are often low mintage, which creates rarity and a potentially higher future value.

The Value of MS70 Silver Eagles

The value of a graded coin is the value of the silver, plus a premium based on its value as a collectible. The most newly minted ones are worth anywhere from around $50 to over $100, depending on what year they were minted, how many received the top grade, and who graded them. Some of the older ones are now worth several thousand dollars. So, these have value, not only to investors, but also to collectors.

The MS70 Silver Eagle was first minted in 1986. Anyone who acquired one of these coins per month since then, would have almost 400 of them today. One estimate of the value of those coins is over $1 million.

Nobody knows if the next 30 years of collecting these will yield that kind of increase. As they say, “Past performance does not predict future results.” Of course, future results could even be better!

Bullion Metals at Dealer Direct Pricing

The Comstock Silver Network has chosen 7K Metals, in Idaho Falls, Idaho, as our exclusive supplier. 7K Metals is a trusted source of the finest precious metals and maintains high standards of accountability and integrity. They use a business model somewhat like Sam’s or Costco. It is basically a precious metals membership club.

The typical supply chain for precious metals involves a complicated network of dealers, brokers, wholesalers and retailers. 7K Metals has been able to position itself near the head of that chain, so that they are able to buy metals at wholesale. Then, they sell the metals to their members at dealer direct prices. Consequently, it is difficult to find lower prices on gold and silver. The dealer direct prices apply to bullion, not graded coins.

Traditionally, gold and silver have been bought primarily by higher net worth people, but 7K Metals’ membership model has made them available to anyone. Also, there are no minimum purchases. Members pay the same price for a single Silver Eagle as they would a large quantity of them.

These dealer direct prices will translate to higher returns and profits later on.

Buy-Back Program

Another nice benefit offered by our supplier is their buy-back program, which offers very attractive buy-back prices when you want to liquidate your metals.

Precious Metals Education

7K Metals also provides industry education. Understanding that owning precious metals can be confusing and intimidating, the company offers an extensive online course of instruction, free to our members. This “Buyer’s Certification” program helps you to understand all things related to precious metals. It will help you to become more and more confident in buying and collecting.

Important reasons to consider joining us:

- To diversify your portfolio – a way of protecting and insuring traditional investments.

- To accumulate a personal reserve of precious metals.

- To create a potentially significant supplement to your retirement assets.

- To generate an on-going, supplemental income. (Click here for details.)

Sometimes our members join for just one of these reasons; sometimes it’s for all four!

Standard Membership

- Member-direct pricing on precious metals bullion purchases

- Access to exclusive, low-mintage collectibles

- Preferred pricing on specialty coins at enrollment

- SoundMoney Wallet

- Standard access to Stack & Sell

- 7K Precious Metals Education Program

- 7K Advantage Rewards Program

- Access to health plans

- Affiliate program

- Personal website

- 3 months’ access to 7K Wealth Systems app

- Standard business building reporting package (Dashboard and Downline Explorer)

- Standard training

- Annual membership fee: $199

Premium Membership

- Member-direct pricing on precious metals bullion purchases

- Access to exclusive, low-mintage collectibles

- Preferred pricing on specialty coins at enrollment

- SoundMoney Wallet

- Full access to Stack & Sell

- 7K Precious Metals Education Program

- 7K Advantage Rewards Program

- Access to health plans

- Affiliate program

- Personal website

- 12 months’ access to 7K Wealth Systems app

- Premium business building reporting package (Dashboard, Downline Explorer, Graphical Downline, Team Viewer, Downloadable CSV File)

- Premium training

- Annual membership fee: $499

The Advantages of Membership

It is almost always the case that there is strength in numbers, and that is certainly true with membership in the Comstock Silver Network.

Our members are from many different places, but we are a network of like-minded individuals – part of a support system where there is a building of trust. And that creates opportunities for collaboration and cooperation.

Membership does have its advantages.

The Bottom Line

If you agree that precious metals are valuable to own … and that silver out-shines all the other precious metals … and that the strategy we have designed here at the Comstock Silver Network is a reasonable and a sound strategy, then we would encourage you to join us. Today!

Please feel free to contact us if you would like to ask questions, discuss membership in our group, or help you register for an account.

How To Open An Account With 7K Metals

Go to the following website: 7KMetals.com/comstock

- Click on “Get Started” tab.

- Select either Standard or Premium membership.

- Select Basic, Variety or Specialty monthly Auto-Saver.

- Complete the Registration Form.